Worsening economy, weak demand cloud over U.S. EV companies

More than 90 new EV models are expected to hit the U.S. market by 2026, but many companies will struggle to hit profitable sales.

A number of electric vehicle start-up companies in the United States will announce their second-quarter financial reports in the next few days. Investors are expected to understand the impact of the price war on the electric vehicle industry and how these companies will manage cash in the face of tight funds.

Tesla, the market leader, has warned of "turbulent times," while traditional automakers with deep pockets, including Ford, continue to lose money in the electric car business. Electric truck maker Lordstown Motors filed for bankruptcy in June, becoming the first company in the industry to fail.

Like celebrities, there are top-notch new car companies in the United States. But unlike celebrities, traffic cares about data, but what these new car companies compete is profit is sales and who nourishes the larger market.

In this, Tesla undoubtedly occupies an absolute top position, especially after it achieved its first full-year profit in 2020, its momentum has been out of control. It was also from this year that Tesla gradually opened up the gap with the new forces around it.

In addition to Tesla, at least 20 electric vehicle-related companies in the United States achieved backdoor listings through special purpose acquisition companies (SPACs) that year. Among them, two car companies, Rivian and Lucid, were once regarded as "Tesla's strong competitors".

In November 2021, Rivian officially landed on the capital market, setting the record for the largest IPO in 2021 and the sixth largest in US history. A month later, the star car company was beaten back to its original shape.

With the arrival of the poor performance report, Rivian faced the first round of lifting the ban immediately after listing. As the fourth largest shareholder, Ford Motor sold Rivian's stock through Goldman Sachs after the lock-up period expired.

Three years have passed, and Rivian is also struggling, facing a series of troubles such as stock price diving, being shorted by institutions, and market value falling below net assets. Wall Street has since repeatedly expressed disappointment with Rivian's story.

The development of another new force, Lucid, has not been smooth sailing. Lucid Air, which has high hopes, will not be delivered to customers until 2021 due to supply chain and other issues. According to public data, Lucid will produce a total of 7,180 vehicles in 2022, which is lower than its original planned production target of 20,000 vehicles.

After announcing a funding round of about $3 billion, Lucid will end the second quarter with a cash balance of $2.76 billion, up from $900 million at the end of the first quarter, according to a Visible Alpha survey of six analysts. But compared with its peak period, Lucid's market value has fallen by more than 80%.

Like China's new car-making forces, gradually, when the capital market returns to rationality, some new car-making forces that have not yet achieved mass production and delivery in the initial stage of listing obviously cannot keep up with the pace. In particular, the Federal Reserve will raise interest rates at the fastest rate in 40 years starting in March 2022, which is very different from the environment in which hot money flowed at that time, and the capital market has changed.

US electric truck maker Lordstown Motors filed for bankruptcy in June, becoming the first company in the industry to fail.

As a member of the backdoor listing of electric vehicles in 2020, Lordstown Motors, which was established in 2018, and other start-up companies have high hopes from investors. At the initial stage of listing, the market value was once as high as 1.6 billion US dollars, and it was stated that the company had received more than 100,000 orders.

However, the well-known short-selling agency Hindenburg stated in a report released in 2021 that most of the orders for 100,000 vehicles were fake. Subsequently, Lordstown was investigated by the US SEC, questioning its order data falsification, and the investigation has continued to this day.

Lordstown Motors admitted frankly in its financial report for the fourth quarter of 2022 that as of February 2023, only about 40 Endurance vehicles will be produced in total, and the number of vehicles delivered will only be 6, which is far less than the original target.

The experience of Lordstown Motors is also a microcosm of the new American car-making forces from peak to trough. "The bankruptcy of Lordstown Motors means that the era of new car success is over!" said Thomas Hayes, chairman of the American hedge fund Great Hill Capital.

And this is only 3 years away from the highlight moment of the new American car-making forces.

Up to now, according to the "Automotive News" survey of the financial situation of 10 new car manufacturers in the United States, most of them are facing the dilemma of cash flow, and only 4 companies have enough cash on hand to maintain operations for more than a year . According to the latest documents of the U.S. Securities and Exchange Commission (SEC), only a few new car-making companies can afford cash consumption for more than two years.

In the current situation, there is almost no advantage for the new American car-making forces. Musk said last year that Lucid would go out of business in the near future, and Rivian faces the same fate.

Thomas Hayes said: "Besides Tesla, the only ones that have a chance will be the traditional automakers. But so far, they are also burning money to enter the electric vehicle industry.

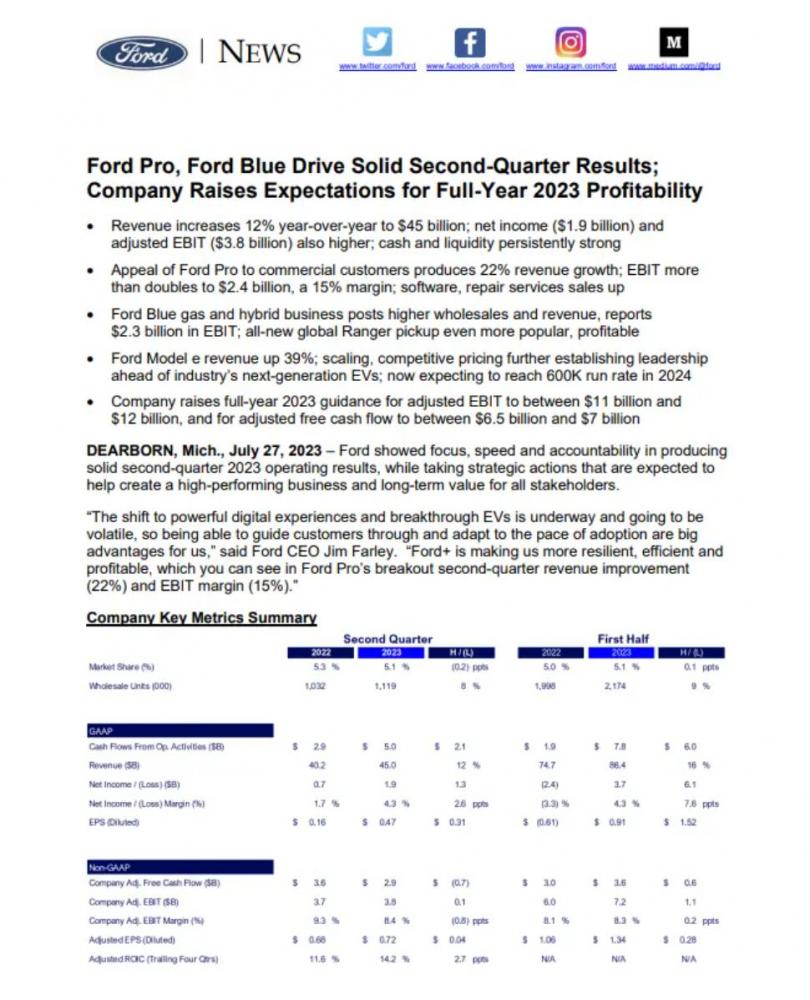

Ford Motor is a typical example. The financial report shows that Ford's Q2 revenue reached US$45 billion, a year-on-year increase of 12%; net income was US$1.9 billion, adjusted EBIT increased to US$3.8 billion, and the EBIT margin was 8.4%. Cash and liquid assets continued to maintain strong performance. As of the end of the second quarter, cash was close to US$30 billion and liquid assets exceeded US$47 billion.

But the impressive performance did not conceal the frustration of this century-old car company in the electric car business. The financial report shows that although the revenue of the Ford Model e business unit focusing on electric vehicles and innovative technologies increased by 39% in the second quarter, the revenue was only US$1.8 billion, while the operating loss was as high as US$1.08 billion; throughout the first half of the year, Ford’s electric vehicle business lost money. Up to $1.8 billion.

Affected by the electric vehicle pricing environment, investment in next-generation products and capacity, and other costs, Ford expects to expand its losses to $4.5 billion this year, which is 50% higher than its previous forecast.

U.S. electric vehicle sales were up about 50% through June compared with the first half of 2022, according to Automotive Intelligence. And Tesla's market share of U.S. electric vehicle sales is down nearly 10 percentage points from a year ago.

The U.S. electric-vehicle market is growing, analysts and industry data show, but not fast enough in the latest quarter to stop some automaker dealers from piling up unsold EVs or Tesla to avoid a new round of electric vehicles. cut prices.

Inventory builds and price cuts may just be a short-term pause in the growth of the EV market. But it could suggest that even with federal and state subsidies, it will be more costly and difficult to boost U.S. EV sales above the current 7% market share level.

The multibillion-dollar investments North American automakers have made in electric vehicle-related areas depend on how they perform in the coming quarters. If production of EVs continues to outstrip demand, automakers will have to choose between slashing prices and margins, or slowing down assembly lines.

More than 90 new EV models are expected to hit the U.S. market by 2026, but many will struggle to hit profitable sales, according to AutoForecast Solutions.

Russian

Russian