Volkswagen needs two "hearts" beating simultaneously

After the automobile industry switches to the new energy track, independent brands are rewriting the pattern of the Chinese automobile market at an extremely fast speed.

French and Korean cars that were once popular have lost much of their voice. Sales of American cars, except for Tesla, have continued to slump. Even Japanese cars, which have always had strong reputations and sales, have seen their sales in China drop by 20% this year. In this turbulent situation, only German cars are currently maintaining stability, both in terms of sales and reputation.

The stability of German cars is due to the fact that German cars were the first to enter China and their market share in China once exceeded 50%, establishing a good reputation and fan base. On the other hand, it also stems from the popularity of German cars. The areas of advantage - car manufacturing technology, chassis driving control, premium quality, etc. have a high moat.

50% of the Volkswagen brand's business and 30% of the Volkswagen Group's business come from the Chinese market. Not only that, the entire German car industry is very dependent on the Chinese market. In 2022, 38.3% of Volkswagen Group's car sales will come from the mainland Chinese market, 36.8% of Mercedes-Benz Group's car sales will come from the Chinese mainland market, and 33% of BMW's car sales will come from the Chinese mainland market.

The question is how long the success and glory of the German fuel vehicle era can last after switching to the new energy track. After all, independent brands that are already leading the new energy market are also beginning to impact the mid-to-high end.

Under this crisis, as the leader of German cars, Volkswagen's new strategy is emerging. As Volkswagen China CEO Meng Xia said in an interview, Volkswagen has "two hearts" beating at the same time, and one is "German heart" and one is "Chinese heart".

Volkswagen's "Two Hearts" strategy responded to the global market by cooling down the "German Heart". Global sales increased by 16.9% in the first half of the year. At the same time, the "Chinese Heart" strategy also allowed Volkswagen to stabilize its position in the Chinese market, with electric vehicles The Auto ID. family is firmly at the forefront of the joint venture.

While looking at the transformation of German cars through Volkswagen's strategy, we can also reflect on the strategy of Chinese cars. For Chinese car companies, the automotive industry seems to have only one market. In this market, electric vehicles are the future and fuel vehicles are outdated and are being replaced. In this narrative, Chinese car companies are winning overall, while other car companies are losing ground.

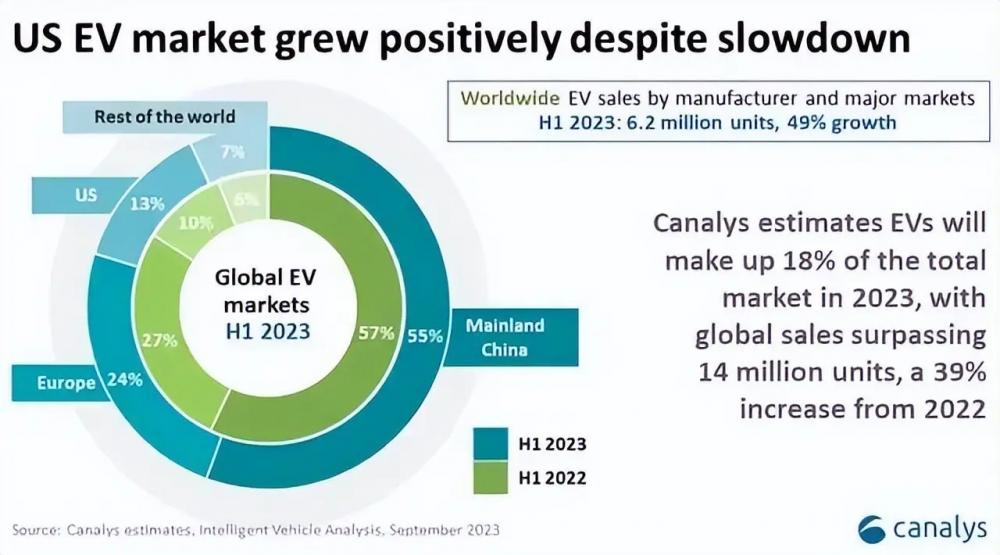

But in fact, looking at the world, there are actually two automobile markets. The Chinese market has entered the electric vehicle society at the speed of "the fast fish eats the slow fish", and the trend has been difficult to reverse; and throughout the world, although Electrification is also progressing, but whether it is policy support, infrastructure construction, or industrial chain popularization, it is far behind China and is advancing at a snail's pace.

In contrast, Chinese car companies that are overly focused on the Chinese market are facing many new challenges. As the involution intensifies, Chinese car companies regard going overseas as a new way out. However, after entering the global market, many countries do not have as strong policy support and infrastructure construction capabilities as China. Coupled with restrictions in tariffs, laws and other aspects, Chinese electric vehicles will face all-round competition from fuel vehicles, hybrid vehicles, etc. The argument that electric cars are the future may not win out.

Therefore, when Chinese car companies go overseas, in addition to strengthening the advantages of electric vehicles, they may need to learn from Volkswagen's "two hearts" strategy and build an "overseas heart" to deal with challenges in different dimensions around the world.

Russian

Russian